DEFINITIVE PROXY STATEMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant | ||

| Filed by a Party other than the Registrant | ||

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| Definitive Proxy Statement | ||

| Definitive Additional Materials | ||

| Soliciting Material Pursuant to §240.14a-12 | ||

| FAT BRANDS INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| Payment of Filing Fee (Check the appropriate box): | ||

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary materials. | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

November 20, 2020

Dear Stockholder:

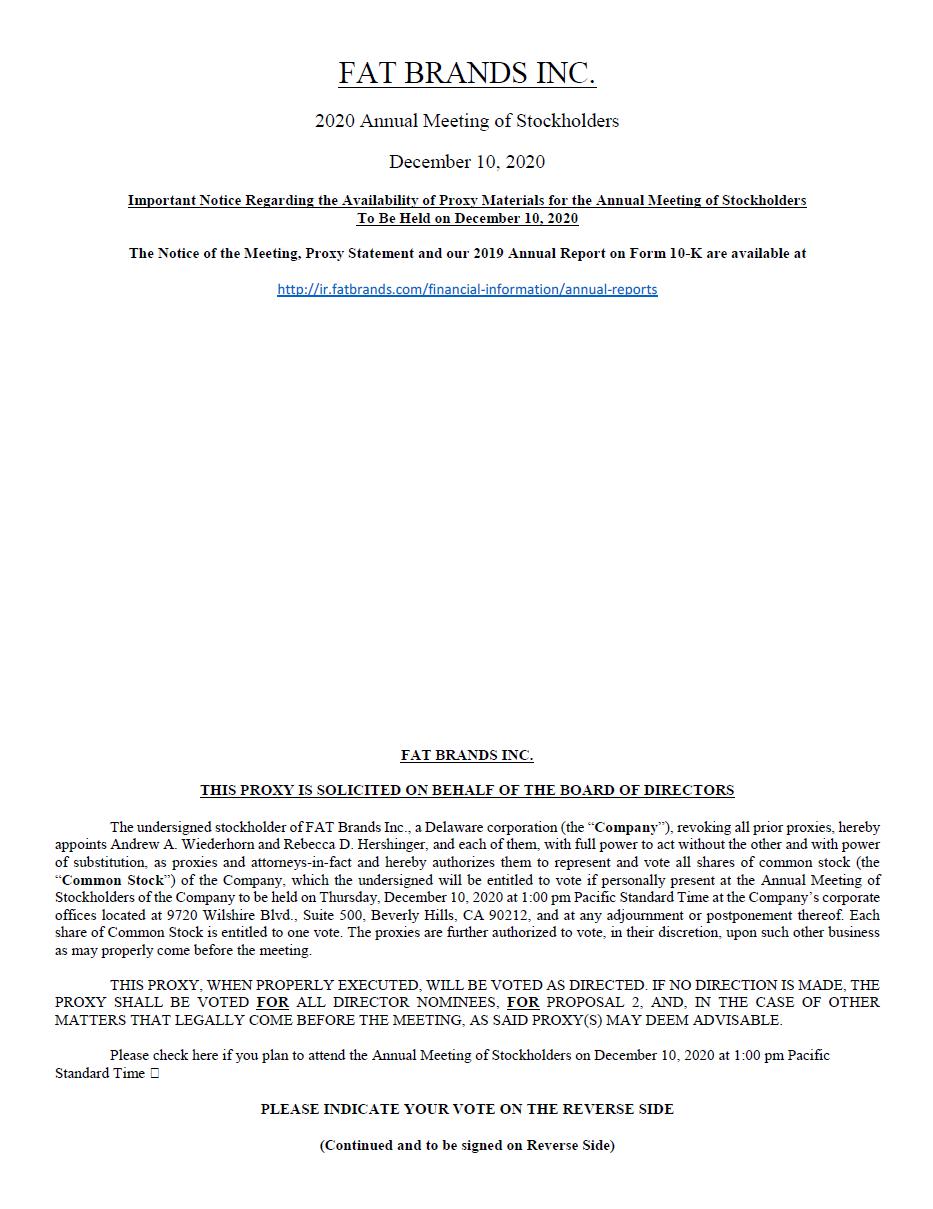

You are cordially invited to the 2020 annual meeting of stockholders (the “Annual Meeting”) of FAT Brands Inc. (the “Company”) to be held on Thursday, December 10, 2020 at 1:00 pm Pacific Standard Time at the Company’s corporate offices located at 9720 Wilshire Blvd., Suite 500, Beverly Hills, CA 90212.

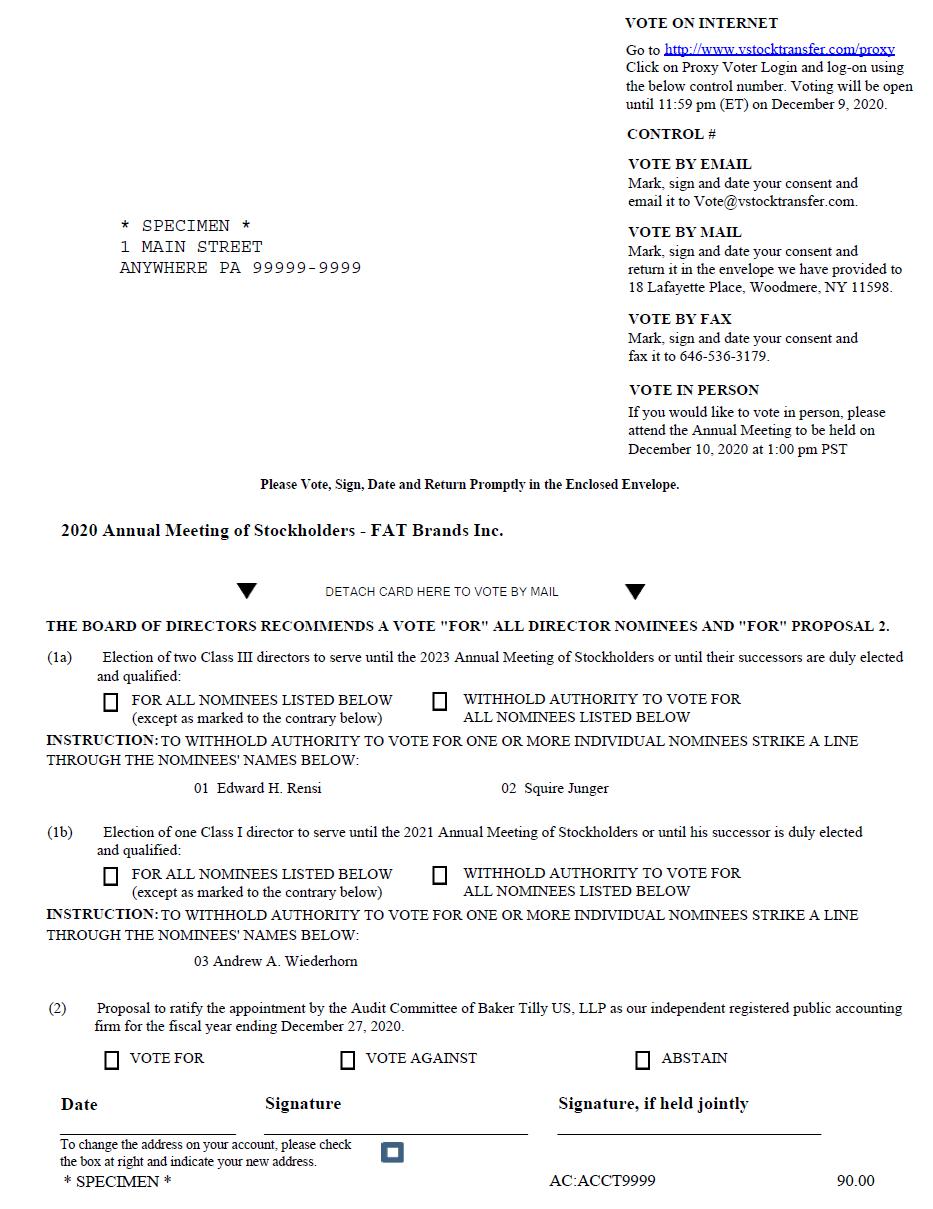

At the Annual Meeting, you will be asked to elect two Class III directors and one Class I director to our Board of Directors and ratify the appointment of Baker Tilly US, LLP, Certified Public Accountants, as our independent registered public accounting firm for the fiscal year ending December 27, 2020.

Your vote is important. We encourage you to vote promptly whether or not you plan to attend the meeting. Please sign, date and mail the proxy card that you received in the mail in the envelope provided. Instructions regarding voting are contained on the proxy card. Alternatively, you may vote by e-mail, fax or via the internet.

If you plan to attend the meeting, please bring your notice, proxy card or proof of your ownership of FAT Brands Inc. common stock as of November 11, 2020 as well as a valid picture identification. Whether or not you attend the meeting, we encourage you to consider the matters presented in the proxy statement and vote as soon as possible.

Due to the current environment related to the COVID-19 pandemic, we will enforce the appropriate social distancing protocols and request that all stockholders who attend the Annual Meeting in person must wear an appropriate face covering. In addition, the Company will employ a screener to conduct temperature checks of all attendees prior to allowing admission to the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to Be Held on December 10, 2020 — the Company’s Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K are available at http://ir.fatbrands.com/financial-information/annual-reports.

FAT Brands Inc.

9720 Wilshire Blvd., Suite 500

Beverly Hills, CA 90212

November 20, 2020To the Stockholders of FAT Brands Inc.:

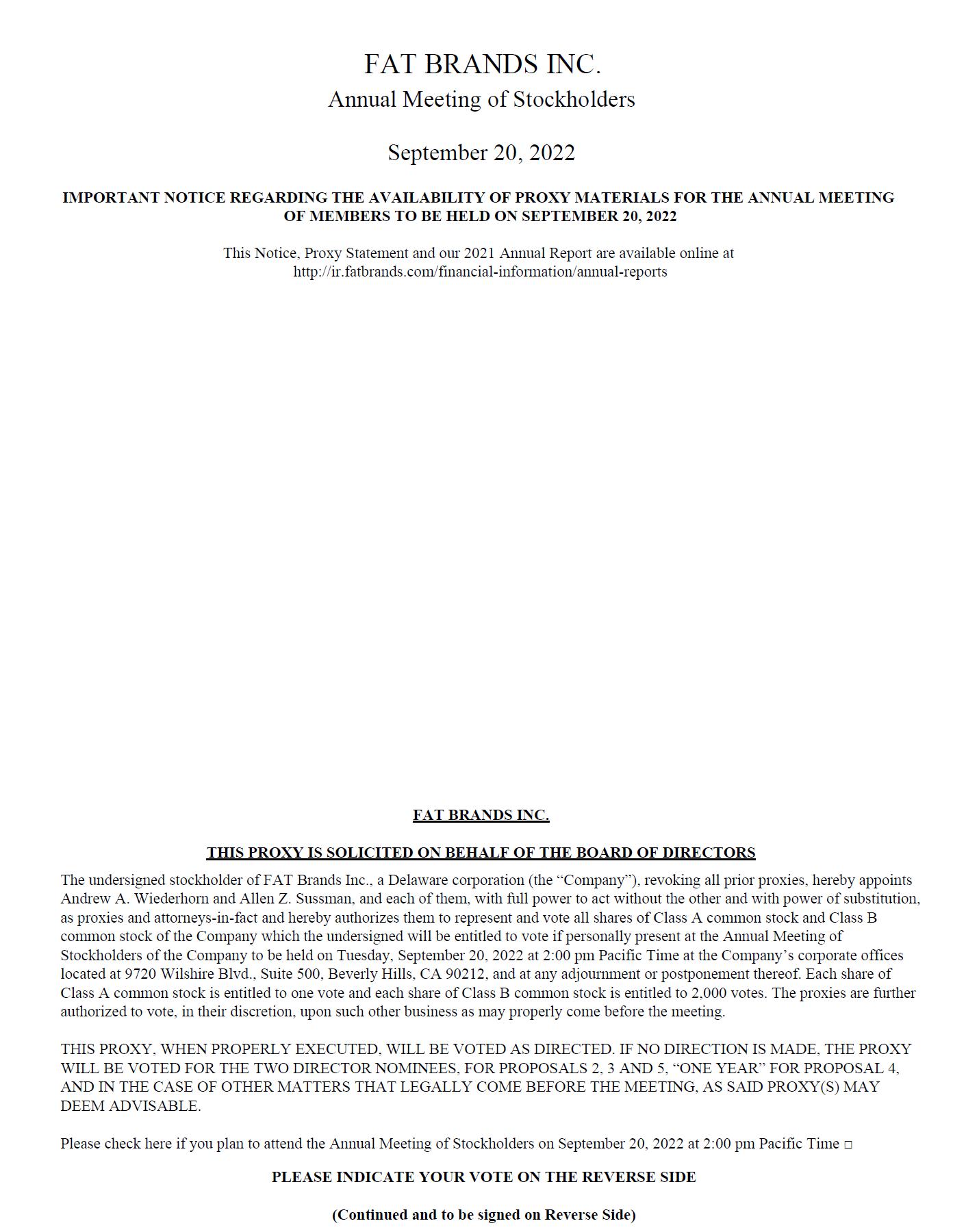

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2020 annual meeting2022 Annual Meeting of stockholdersStockholders (the “Annual Meeting”) of FAT Brands Inc., a Delaware corporation (the “Company”), will be held on Thursday, December 10, 2020Tuesday, September 20, 2022 at 1:2:00 pmp.m. Pacific Standard Time.,Time, at the Company’s corporate offices located at 9720 Wilshire Blvd., Suite 500, Beverly Hills, CA 90212, for the following purposes:

1. to elect two Class III directors to our Board of Directors to serve until the 2023 Annual Meeting of Stockholders or until their successors are elected and qualified;

2. to elect one Class I director to our Board of Directors to serve until the 2021 Annual Meeting of Stockholders or until his successor is elected and qualified;

3. to ratify the decision of our Audit Committee to appoint Baker Tilly US, LLP, Certified Public Accountants, as our independent registered public accounting firm for the fiscal year ending December 27, 2020; and

4. to transact such other business as may properly come before the Annual Meeting and any adjournment or postponements.

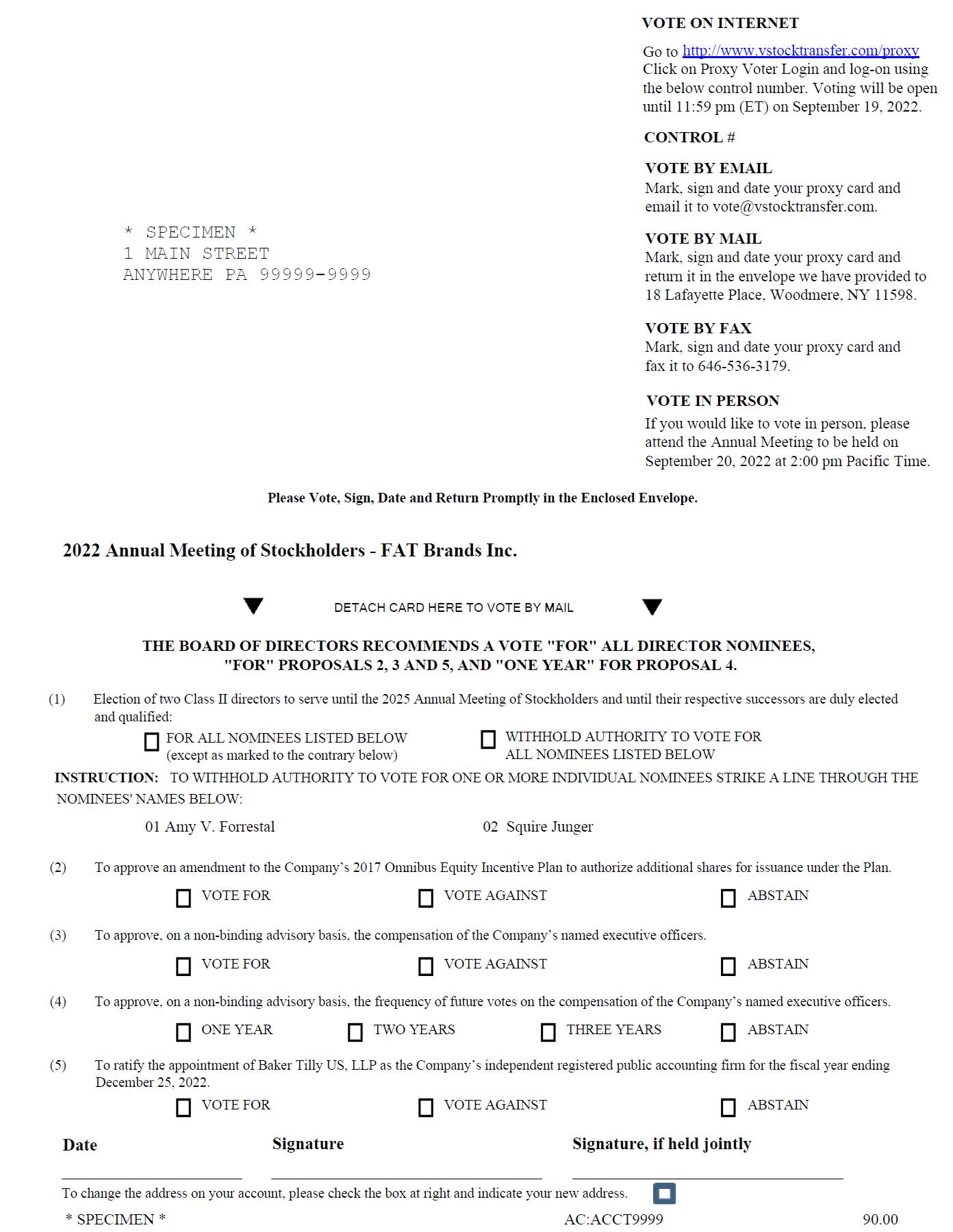

| 1. | To elect two Class II directors to the Board of Directors, each to serve until the 2025 Annual Meeting of Stockholders and until their respective successors are elected and qualified. | |

| 2. | To approve an amendment to the Company’s 2017 Omnibus Equity Incentive Plan to authorize additional shares for issuance under the Plan. | |

| 3. | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers. | |

| 4. | To approve, on a non-binding advisory basis, the frequency of future votes on the compensation of the Company’s named executive officers. | |

| 5. | To ratify the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 25, 2022; and | |

| 6. | Transact such other business as may properly come before the Annual Meeting and any adjournment or postponements thereof. |

The Board of Directors has fixed the close of business on November 11, 2020August 3, 2022 as the record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponements. It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. Whether or not you plan to attend the Annual Meeting, please provide your proxy by following the instructions described below in the Proxy Statement.

Important notice regarding the availability of proxy materials for the Annual Meeting of Stockholders to be held on September 20, 2022: The Proxy Statement and 2021 Annual Report on Form 10-K are available online at http://ir.fatbrands.com/financial-information/annual-reports.

Your vote is very important, regardless of the number of shares you own. In accordance with Securities and Exchange Commission (“SEC”) rules, instead of mailing a printed copy of our proxy materials to each stockholder of record, we are furnishing proxy materials to our stockholders via the Internet. If you received a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail, you will not receive a printed copy of the proxy materials unless you request to receive them in accordance with the instructions provided in the Notice. The Notice contains instructions on how to access and review all of the important information contained in the proxy materials over the Internet. The Notice also instructs how you may submit your notice or proxy card. On or about November 20, 2020, we mailedover the Internet. If you received a Notice and would like to receive a printed copy of our proxy card, proxy statement andmaterials, including our Annual Report to our stockholders.

Please submit your proxy by marking, dating and signingon Form 10-K, follow the proxy cardinstructions for requesting such materials included and returning it promptly in the envelope enclosed, or by using the other voting methods available by e-mail, fax or via the internet. If you are able to attend the Annual Meeting and wish to vote your shares personally, you may do so at any time before the proxy is exercised.

Due to the current environment related to the COVID-19 pandemic, we will enforce the appropriate social distancing protocols and request that all stockholders who attend the Annual Meeting in person must wear an appropriate face covering. In addition, the Company will employ a screener to conduct temperature checks of all attendees prior to allowing admission to the Annual Meeting.Notice.

| By order of the Board of Directors, | |

| Secretary |

TABLE OF CONTENTS

FAT BRANDS INC.

9720 Wilshire Blvd., Suite 500

Beverly Hills, CA 90212

ANNUAL MEETING OF STOCKHOLDERSDecember 10, 2020

September 20, 2022

PROXY STATEMENT

ANNUAL MEETING AND PROXY SOLICITATION INFORMATION

The accompanying proxy is solicited by the Board of Directors (the “Board”) of FAT Brands Inc., a Delaware corporation (the(“we”, “us”, “our” or the “Company”), for use at our 2020 annual meeting2022 Annual Meeting of stockholdersStockholders (the “Annual Meeting”) to be held on Thursday, December 10, 2020Tuesday, September 20, 2022 at 1:2:00 pmp.m. Pacific Standard Time at the Company’s corporate offices located at 9720 Wilshire Blvd., Suite 500, Beverly Hills, CA 90212, and at any adjournment or postponements thereof.

ThisPursuant to rules adopted by the Securities and Exchange Commission, or SEC, we are making this proxy statement available to our stockholders electronically via the Internet. On or about August 11, 2022, we are mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to the holders of our Class A common stock and Class B common stock as of the close of business on August 3, 2022 (the “record date”), other than those stockholders who previously requested electronic or paper delivery of communications from us. The Notice contains instructions on how to access over the Internet an electronic copy of our proxy materials, including this proxy statement and accompanyingour 2021 Annual Report on Form 10-K. The Notice also contains instructions on how to request a paper copy of our proxy card were first sentmaterials. We believe that this process will allow us to our stockholders on or about November 20, 2020. Any proxy given pursuant to this solicitation may be revoked byprovide you with the person giving it at any time before its use by delivering to us (Attention: Secretary) no later than 5:00 p.m. local time December 9, 2020,information you need in a written noticetimely manner, while conserving natural resources and lowering the costs of revocation, delivery of a duly executed proxy card bearing a later date, or by attending the Annual Meeting and voting in person.Meeting. The Notice provides instructions on how to cast your vote.

YOUR VOTE IS IMPORTANT. PLEASE VOTE AS SOON AS POSSIBLE ONLINE, BY PHONE OR BY COMPLETING, SIGNING AND DATINGUSING ONE OF THE PROXY CARD ENCLOSED WITH THIS PROXY STATEMENT AND RETURNING ITMETHODS DESCRIBED IN THE ENCLOSED POSTAGE-PAID ENVELOPE.NOTICE.

Who is entitled to vote?

If you were a holder of FAT Brands Inc. Class A common stock or Class B common stock at the close of business on November 11, 2020, the (“record date,”) either as a stockholder of record or as the beneficial owner of shares held in street name, you may direct a vote at the Annual Meeting. As of the record date, we had 11,926,264 shares of our common stock outstanding and entitled to be voted. Eachvote 15,300,691 shares of Class A common stock and 1,270,805 shares of Class B common stock. Stockholders will have the right to one vote per share of Class A common stock and 2,000 votes per share of Class B common stock held as of the record date. Our Class A common stock and Class B common stock will vote as a single class on all matters described in this proxy statement for which your vote is entitledbeing solicited. Stockholders are not permitted to one vote.cumulate votes with respect to the election of directors.

What does it mean to be a stockholder of record or beneficial holder and who can vote in person at the meeting?meeting?

Stockholder of Record: Shares Registered in Your Name. If on the record date, your shares were registered directly in your name with the Company’s transfer agent, VStock Transfer, then you are a stockholder of record and you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote by completing your proxy card, by telephone, or through the internet, to ensure that your vote is counted.

Beneficial Holder: Owner of Shares Held in Street Name: If, on the record date, your shares were held in an account at a broker, bank, or other financial institution (collectively referred hereinto as “broker”“broker”), then you are the beneficial holder of shares held in “street name” and these proxy materials are being forwarded to you by that broker. The broker holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial holder, you have the right to direct your broker on how to vote the shares in your account. As a beneficial holder, you are invited to attend the Annual Meeting. However, since you are not a stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker giving you the legal right to vote the shares at the Annual Meeting, as well as satisfy the Annual Meeting admission criteria set out in the Notice.Meeting.

| 1 |

What constitutes a quorum?

Our Bylaws require that a quorum – that is, the holders of a majority of allthe voting power of the issued and outstanding shares of our commoncapital stock entitled to vote at the Annual Meeting – be present, in person or by proxy, before any business may be transacted at the Annual Meeting (other than adjourning the Annual Meeting to a later date to allow time to obtain additional proxies to satisfy the quorum requirement).

How do I vote by proxy before the meeting?

Before the meeting, you may vote your shares in one of the following three ways if your shares are registered directly in your name with our transfer agent, VStock Transfer.

Please refer to the proxy card for further instructions on voting via the Internet and by telephone. Please follow the directions on your proxy card carefully.

May I vote my shares in person at the Annual Meeting?

Due to the COVID-19 pandemic, attendees at this year’s Annual Meeting will be required to wear a face covering and adhere to social distancing requirements. Attendance at the Annual Meeting will be limited to stockholders or their proxy holders. If you are a proxy holder for a stockholder of record whose shares are registered in his or her name, you must provide a copy of thea proxy from the stockholder of record.record authorizing you to vote such shares. If you are a beneficial holder who holds shares through a broker, bank or similar organization, you must provide proof of beneficial ownership as of the close of business on the record date, such as a brokerage or bank account statement, a copy of the proxy from the broker or other agent, or other similar evidence of ownership. Each attendee must also present valid photo identification, such as a driver’s license or passport. Cameras recording devices and other electronicrecording devices will not be permitted at the Annual Meeting.

How can I revoke my proxy?

If you are a stockholder of record and have sent in your proxy, you may change your vote by revoking your proxy by means of any one of the following actions which, to be effective, must be taken before your proxy is voted at the Annual Meeting:

| ● | Sending a written notice to revoke your proxy to the Company’s Secretary at its corporate offices. To be effective, the Company must receive the notice of revocation before the Annual Meeting commences. | |

| ● | Transmitting a proxy by mail at a later date than your prior proxy. To be effective, the Company must receive the later dated proxy before the Annual Meeting commences. If you fail to date or to sign that later proxy, however, it will not be treated as a revocation of an earlier dated proxy. | |

| ● | Attending the Annual Meeting and voting in person or by proxy in a manner different than the instructions contained in your earlier proxy. |

If you are a beneficial holder you may submit new voting instructions by contacting your broker. You may also change your vote or revoke your voting instructions in person at the Annual Meeting if you obtain a signed proxy from the broker giving you the right to vote the shares.

What will happen if I do not vote on a proposal?

A properly executed proxy received by us prior to the Annual Meeting, and not revoked, will be voted as directed by the stockholder on that proxy. If a stockholder provides no specific direction with respect to a proposal, a signedproperly completed proxy card returned by a stockholder will be voted in accordance with the Board of Directors’ recommendations as set forth in this proxy statement. As of the date of this proxy statement, we are not aware of any matters to be voted on at the Annual Meeting other than as stated in this proxy statement and the accompanying notice of Annual Meeting. If any other matters are properly brought before the Annual Meeting, the proxy card gives discretionary authority to the persons named in it to vote the shares in their own discretion.

What vote is required to approve each item?

Proxies marked as abstentions or withheld votes will be counted as shares that are present and entitled to vote for purposes of determining whether a quorum is present. If a broker indicates on its proxy that it does not have discretionary voting authority to vote shares on one or more proposals at the Annual Meeting (a “broker non-vote”“broker non-vote”), such shares will still be counted in determining whether a quorum is present. Brokers or other nominees who hold shares in “street name” for the beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they have not received instructions from the beneficial owner. However, brokers are not allowed to exercise their voting discretion with respect to the election of directors or other “non-routine” proposals without specific instructions from the beneficial owner. Of the matters on the agenda for the Annual Meeting, only the ratification of the selection of our auditors is considered to be a “routine” proposal for the purposes of brokers exercising their voting discretion.

| 2 |

Proposal No. 1 – Election of Directors. AssumingProvided that a quorum of the stockholders is present in person or by proxy at the Annual Meeting, a plurality of the votes cast is required for the election of directors. As a result, the two nominees who receive the highest number of votes cast for Class III director will be elected as Class III directors, and the one nominee who receives the highest number ofII directors. Withheld votes, cast for Class I director will be elected as a Class I director. “Withhold” votes will have no effect. Abstentionsabstentions and broker non-votes will have no effect on the results of the election of directors.

Proposal No. 2 – Vote to Amend 2017 Omnibus Equity Incentive Plan. The affirmative vote of the holders of a majority of the voting power of the shares represented in person or by proxy at the Annual Meeting and entitled to vote on this item will be required for the approval of this proposal. This proposal is considered to be a “non-routine” matter, so if you hold your shares in street name and do not provide voting instructions to your broker, bank, or other agent that holds your shares, your broker, bank, or other agent will not have discretionary authority to vote your shares on this proposal. Abstentions will have the same effect as a vote against this proposal, and broker non-votes will have no effect on the results of this proposal.

Proposal No. 3 – Non-Binding Advisory Vote on the Compensation of Named Executive Officers. The affirmative vote of the holders of a majority of the voting power of the shares represented in person or by proxy at the Annual Meeting and entitled to vote on this item will be required for the approval of this proposal. This proposal is considered to be a “non-routine” matter, so if you hold your shares in street name and do not provide voting instructions to your broker, bank, or other agent that holds your shares, your broker, bank, or other agent will not have discretionary authority to vote your shares on this proposal. Abstentions will have the same effect as a vote against this proposal, and broker non-votes will have no effect on the results of this proposal.

Proposal No. 4 – Non-Binding Advisory Vote on the Frequency of Future Votes on the Compensation of Named Executive Officers. The option receiving the greatest number of votes cast (one, two or three years) will be considered the frequency selected by the stockholders. This proposal is considered to be a “non-routine” matter, so if you hold your shares in street name and do not provide voting instructions to your broker, bank, or other agent that holds your shares, your broker, bank, or other agent will not have discretionary authority to vote your shares on this proposal. Abstentions and broker non-votes will have no effect on the results of this proposal.

Proposal No. 5 – Vote for the Ratification of Selection of Independent Public Accounting Firm. The affirmative vote of the holders of a majority of the voting power of the shares represented in person or by proxy at the Annual Meeting and entitled to vote on this item will be required for the ratification of the selection of Baker Tilly US, LLP. This proposal is considered to be a “routine” matter, so if you hold your shares in street name and do not provide voting instructions to your broker, bank, or other agent that holds your shares, your broker, bank, or other agent will have discretionary authority to vote your shares on this proposal. Abstentions will have the same effect as a vote against this proposal.

Other Items. For any other item of business that may be presented at the Annual Meeting, the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote at the meeting will be required for approval. A properly executed proxy marked “ABSTAIN” with respect to any such matter will not be voted. Because abstentions represent shares entitled to vote, the effect of an abstention will be the same as a vote against a proposal. Broker non-votes will have no effect on the results of such a proposal.

Can I exercise rights of appraisal or other dissenters’ rights at the Annual Meeting?

No. Under Delaware law, holders of our voting stock are not entitled to demand appraisal of their shares or exercise similar rights of dissenters as a result of the approval of any of the proposals to be presented at the Annual Meeting.

| 3 |

Who is paying for this proxy solicitation?

WeThe Company will pay the cost of soliciting proxies for the Annual Meeting. Proxies may be solicited by our regular employees in person, or by mail, courier, telephone or facsimile. Arrangements also may be made with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of stock held of record by such persons. We may reimburse such brokerage houses, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith.

Voting Agreement with Fog Cutter Capital Group Inc.

Our largest stockholder, Fog Cutter Capital Group Inc. (“FCCG”), has entered into a Voting Agreement with us which provides that FCCG will, subject to certain conditions, vote all of its stock in the Company at annual and special meetings of our stockholders, including the Annual Meeting, and any actions taken by written consent of our stockholders, in the same proportion as the votes or consents cast by our other stockholders on all matters, except matters involving the sale, merger or change of control of the Company. Such obligations of FCCG under the Voting Agreement are not yet effective, and therefore FCCG has formed a special committee consisting of two directors of FCCG (the “Special Committee”) who are authorized to vote in their discretion FCCG’s shares at the Annual Meeting.

What does it mean if I receive more than one Notice of Annual Meeting?

Some stockholders may have their shares registered in different names or hold shares in different capacities. For example, a stockholder may have some shares registered in his or her name, individually, and others in his or her capacity as a custodian for minor children or as a trustee of a trust. In that event, you will receive multiple copies of this proxy statement and multiple proxy cards. If you want all of your votes to be counted, please be sure to sign, date and return all of those proxy cards.

What does it mean if multiple members of my household are stockholders but we only received one Notice of Annual Meeting or set of proxy materials in the mail?

The Securities and Exchange Commission, or SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for notices and proxy materials with respect to two or more stockholders sharing the same address by delivering a single notice or set of proxy materials addressed to those stockholders. In accordance with a prior notice sent to certain brokers, banks, dealers or other agents, we are sending only one notice or full set of proxy materials to those addresses with multiple stockholders unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,” allows us to satisfy the requirements for delivering notices or proxy materials with respect to two or more stockholders sharing the same address by delivering a single copy of these documents. Householding helps to reduce our printing and postage costs, reduces the amount of mail you receive and helps to preserve the environment. If you currently receive multiple copies of the notice or proxy materials at your address and would like to request “householding” of your communications, please contact your broker. Once you have elected “householding” of your communications, “householding” will continue until you are notified otherwise or until you revoke your consent.

To receive a separate copy, or, if a stockholder is receiving multiple copies, to request that we only send a single copy of the Notice of Annual Meeting and proxy materials,Internet Availability of Proxy Materials, you may contact us at our corporate offices at 9720 Wilshire Blvd., Suite 500, Beverly Hills, CA 90212, Attention: Corporate Secretary.

ELECTION OF DIRECTORS

At the Annual Meeting, the stockholders will be asked to elect:elect two Class II directors to the Board of Directors to serve until the 2025 Annual Meeting of Stockholders and until their respective successors are elected and qualified.

The term of the existing Class II directors will expire at this year’s Annual Meeting, the terms of the Class III directors will expire at this year’sthe Annual Meeting to be held in 2023, and the terms of the Class III directors will expire at the Annual Meeting of Stockholders to be held in 2022. There are currently no serving Class I directors. In order to rebalance the directors among the three classes, our Board of Directors has proposed the election of Messrs. Rensi and Neuhauser at this year’s Annual Meeting to serve as Class III directors for a three-year term expiring at the 2023 Annual Meeting of Stockholders, and the election of Mr. Wiederhorn to serve as a Class I director for a one-year term expiring at the 2021 Annual Meeting of Stockholders. Mr. Wiederhorn has agreed to stand for re-election as a Class I director.2024.

If a nominee is unable or unwilling to serve, the shares to be voted for such nominee that are represented by proxies will be voted for any substitute nominee designated by the Board of Directors. If a quorum is present at the Annual Meeting, the two nominees for Class III director receiving the highest number of votes cast, in person or by proxy, and the one nominee for Class III director receiving the highest number of votes cast, in person or by proxy, will be elected to serve as a Class III directors and Class I director, respectively.II director. Abstentions and broker nonvotes will have no effect on the election of directors. If not otherwise specified, proxies will be voted “FOR” the two nominees for Class III director listed below and “FOR” the one nominee for Class III director listed below.

| 4 |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

“FOR” THE ELECTION OF EACH OF THE TWO CLASS III NOMINEES NAMED BELOW, AND “FOR” THE ELECTION OF THE ONE CLASS I NOMINEEII NOMINEES NAMED BELOW.

Nominees for Class II Director for Terms Ending at the 2025 Annual Meeting of Stockholders

Amy V. Forrestal, age 56, has served on our Board of Directors since October 2021. Ms. Forrestal is a seasoned executive and investment banker for companies in the restaurant and franchising industries. Ms. Forrestal serves as Managing Director of Brookwood Associates, an investment banking firm based in Atlanta, GA. Ms. Forrestal established Brookwood’s Restaurant and Hospitality Group, and spearheaded noteworthy deals for brands such as Beef O’ Brady’s, Fuddruckers, Rita’s Italian Ice, Quiznos, Zoes Kitchen and The Habit Burger Grill. Prior to joining Brookwood, Ms. Forrestal was a Managing Director in Banc of America Securities’ Mergers and Acquisitions group. Over her 15 years at Banc of America Securities and its predecessor organizations, including NationsBanc Montgomery Securities, Ms. Forrestal advised senior management teams, boards of directors and business owners in a variety of strategic and financial transactions, including acquisitions, leveraged buyouts, exclusive sales, divestitures, ESOPs, public equity and debt offerings and private equity and debt placements. Ms. Forrestal received a Bachelor of Arts degree in math and economics from Duke University. Ms. Forrestal was selected to our Board of Directors because she brings substantial expertise in financial and strategic planning, investment banking, complex financial transactions and mergers and acquisitions, particularly for companies in the restaurant and franchising industries.

Squire Junger, age 72, has served on our Board of Directors since October 2017. Mr. Junger is a co-founder and a managing member of Insight Consulting LLC, a management consulting firm based in the Los Angeles area, providing advice in mergers and acquisitions, corporate divestitures, business integration diagnostics, real estate investment, acquisition, development and construction and litigation support services. Prior to co-founding Insight in 2003 he was a partner at Arthur Andersen LLP, which he joined in 1972. Mr. Junger co-developed and managed the west coast Transaction Advisory Services practice at Andersen, providing comprehensive merger and acquisition consulting services to both financial and strategic buyers and sellers. Mr. Junger is a certified public accountant in California and received Bachelor of Science and M.B.A. degrees from Cornell University. Mr. Junger was selected to our Board of Directors because he brings substantial expertise in financial and strategic planning, public accounting, mergers and acquisitions, and leadership of complex organizations.

Continuing Class III Director Nominees forDirectors with Terms Ending at the 2023 Annual Meeting of Stockholders

Lynne L. Collier, age 54, has served on our Board of Directors since July 2022. Ms. Collier is an experienced capital markets professional, with nearly 30 years of experience in public capital markets and a focus on the restaurant industry. Most recently, Ms. Collier served as a Managing Director in the Investor Relations Division of ICR Inc. Prior to that, Ms. Collier had a 25-year career in equity research as a sell-side Consumer Analyst, including for Loop Capital, Canaccord Genuity and Sterne Agee. Ms. Collier received a bachelor’s degree in finance from Baylor University and an M.B.A. in finance from Texas Christian University. Ms. Collier was selected to our Board of Directors because she brings substantial expertise in the capital markets industry and investor relations, particularly for companies in the restaurant and hospitality industries.

James C. Neuhauser, age 63, has served on our Board of Directors since our inception in March 2017, and became Executive Chairman of the Board in July 2022. He previously served as a Senior Managing Director in the Private Capital Markets Group of Stifel Nicolas & Company from May 2017 until July 2022. Mr. Neuhauser also serves as a managing member of Turtlerock Capital, LLC, a private company that finances and invests in real estate development projects. Mr. Neuhauser previously held senior positions at FBR & Co. over 24 years, including Chief Investment Officer, Head of Investment Banking, Head of the Commitment Committee and a member of the firm’s Executive Committee. Prior to joining FBR, Mr. Neuhauser was a Senior Vice President of Trident Financial Corporation for seven years, where he specialized in managing stock offerings for mutual to stock conversions of thrift institutions. Before joining Trident, he worked in commercial banking with The Bank of New England. Mr. Neuhauser is a CFA charter holder and a member of the Society of Financial Analysts. He received a Bachelor of Arts degree from Brown University and an M.B.A. from the University of Michigan. Mr. Neuhauser was selected to our Board of Directors because he brings substantial expertise in financial and strategic planning, investment banking, complex financial transactions, mergers and acquisitions, and leadership of complex organizations.

| 5 |

Edward H. Rensi, age 76,77, has served on the boardour Board of directors of FAT Brands Inc.Directors since its formationour inception in March 2017, and became Chairman of the Board onin October 20, 2017. In July 2022, Mr. Rensi transitioned to the role of Vice-Chairman of the Board and Lead Independent Director. Mr. Rensi is the retired president and chief executive officer of McDonald’s USA. Prior to his retirement in 1997, Mr. Rensi devoted his entire professional career to McDonald’s, joining the company in 1966 as a “grill man” and part-time manager trainee in Columbus, Ohio. He was promoted to restaurant manager within a year, and went on to hold nearly every position in the restaurant and field offices, including franchise service positions in Columbus Ohio and Washington, D.C. In 1972, he was named Philadelphia district manager, and later became regional manager and regional vice president. In 1978, he transferred from the field to the company’s home office in Oak Brook, Illinois, as vice president of Operations and Training, where he was responsible for personnel and product development. In 1980, he became executive vice president and chief operations officer, and was appointed senior executive vice president in 1982. Mr. Rensi was promoted to president and chief operating office of McDonald’s USA in 1984. In 1991, he was named chief executive officer. As president and chief executive officer, his responsibilities included overseeing all domestic company-owned and franchisee operations, in addition to providing direction relative to sales, profits, operations and service standards, customer satisfaction, product development, personnel, and training. Mr. Rensi was directly responsible for management of McDonald’s USA, which consisted of eight geographic zones and 40 regional offices. During his 13-year term as president, McDonald’s experienced phenomenal growth. U.S. sales doubled to more than $16 billion, the number of the U.S. restaurants grew from nearly 6,600 to more than 12,000, and the number of U.S. franchisees grew from 1,600 to more than 2,700. Since his retirement, Mr. Rensi has held consulting positions. From January 2014 to July 2015, Mr. Rensi served as director and interim CEO of Famous Dave’s of America, Inc. Mr. Rensi received his B.S. in Business Education from Ohio State University in Columbus, Ohio. Mr. Rensi was selected to our Board of Directors because of his long career in hospitality and restaurant franchising, and because he possesses particular knowledge and experience in strategic planning and leadership of complex organizations and hospitality businesses.

Continuing Class I Directors with Terms Ending at the 2024 Annual Meeting of Stockholders

James NeuhauserKenneth J. Anderson, age 61,68, has served on the boardour Board of directorsDirectors since October 2021, and was a director of FAT Brandsour former parent company, Fog Cutter Capital Group Inc. since its formation., until December 2020. Mr. Neuhauser is a Senior Managing Director in the Private Capital Markets Group of Stifel Nicolas & Company. Mr. Neuhauser is also the Managing Member of Turtlerock Capital, LLC, a company that finances and invests in real estate development projects. He previously worked for FBR & Co. forAnderson has more than 2435 years including positionsof experience in advising families, corporate executives and business owners, providing financial strategies related to taxes, estate planning, investments, insurance and philanthropy. Mr. Anderson currently serves as Chief Investment Officer, Head of Investment Banking and Headthe CEO of the Real Estateinvestment firm, Cedar Tree Capital, where he provides strategic planning to a high net-worth family group with a focus on public equities and Financial Services groups in Investment Banking through October 2016. Healternative investments. Prior to Cedar Tree Capital, Mr. Anderson was a founder and client service director at a leading independent wealth management firm, Aspiriant, where he also served as Head of FBR’s Commitment Committee and was a member of the firm’s Executive Committee. Prior to joining FBR,Board of Directors. Mr. NeuhauserAnderson was a Senior Vice Presidentclient service director at myCFO until its sale in 2002 and prior to that a Tax Partner at Arthur Andersen LLP for 20 years. In addition to his decades of Trident Financial Corporation for seven years, where he specialized in managing stock offerings for mutual to stock conversions of thrift institutions. Before joining Trident, he worked in commercial banking with the Bank of New England.professional experience, Mr. NeuhauserAnderson is a CFA charter holdercertified public accountant and a member of the Society of Financial Analysts. He received a Bachelor of Arts from Brown University and an M.B.A. from the University of Michigan.licensed attorney. Mr. NeuhauserAnderson was selected to our Board of Directors because he brings substantial expertise in financial and strategic planning, investment banking complex financial transactions, mergers and acquisitions,public accounting, tax planning and leadership of complex organizations.

Class I Director Nominee for Term Ending at the 2021 Annual Meeting of Stockholders

Andrew A. Wiederhorn, age 54,56, has served on our Board of Directors and as a directorour President and Chief Executive Officer since our inception in March 2017. Mr. Wiederhorn also serves as President and Chief Executive Officer of FAT Brands Inc. since its formation. Mr. Wiederhorn has served as the Chairman of the Board of Directors and Chief Executive Officer of Fatburger North America, Inc. since 2006 and Buffalo’s Franchise Concepts, Inc. since 2011.our principal operating subsidiaries. He also served as the Chairman of the Board of Directors and Chief Executive Officer of our former parent company, Fog Cutter Capital Group Inc., since its formation in 1997. Mr. Wiederhorn previously founded and served as the Chairman of the Board of Directors and Chief Executive Officer of Wilshire Financial Services Group Inc. and Wilshire Credit Corporation. Mr. Wiederhorn received his B.S. degree in Business Administration from the University of Southern California in 1987, with an emphasis in Finance and Entrepreneurship. He previously served on the Board of Directors of Fabricated Metals, Inc., The Boy Scouts of America Cascade Pacific Council, The Boys and Girls Aid Society of Oregon, University of Southern California Associates, Citizens Crime Commission of Oregon, and Economic Development Council for the City of Beverly Hills Chamber of Commerce. Mr. Wiederhorn was also featured as the Fatburger CEO on the CBS television program “Undercover Boss” in 2013. Mr. Wiederhorn was selected to our Board of Directors because of his roleexperience and history in ourthe founding and growth of our Company, his long career in hospitality, and because he possesses particularhis knowledge and experience in strategic planning and leadership of complex organizations, particularly in the restaurant and hospitality businesses.industries.

AMENDMENT TO 2017 OMNIBUS EQUITY INCENTIVE PLAN TO AUTHORIZE ADDITIONAL SHARES FOR ISSUANCE UNDER THE PLAN

At the Annual Meeting, the stockholders will be asked to approve an amendment (the “Share Increase Amendment”) to the Company’s 2017 Omnibus Equity Incentive Plan (the “Plan”) to increase the number of shares of Class II Director with Term EndingA common stock currently issuable under the Plan from 4,000,000 shares to 5,000,000 shares. The Share Increase Amendment has been approved by the Company’s Board of Directors, subject to stockholder approval. The full text of the Share Increase Amendment is attached as Appendix A to this proxy statement.

The Company is seeking to increase the number of shares under the Plan to 5,000,000 shares of Class A common stock in order to have a sufficient number of shares (and an appropriate buffer amount) to award to individuals who newly join the Company and those who are eligible to receive equity awards as part of their ongoing compensation packages, as well as to support future awards to attract, incentivize and retain highly qualified individuals. The Plan originally provided for a maximum of 1,000,000 shares, which amount was increased to 4,000,000 shares in 2021 as the Company’s employee base has grown.

The following table sets forth certain information about awards currently outstanding under the Plan:

| 2017 Omnibus Equity Incentive Plan | As of August 3, 2022 | |||

| Total Stock Options Outstanding | 2,610,936 | |||

| Total Restricted Stock Awards Outstanding | 460,000 | |||

| Weighted-Average Exercise Price of Stock Options Outstanding | $ | 10.51 | ||

| Weighted-Average Remaining Duration of Stock Options Outstanding | 8.55 years | |||

| Total shares available for grant under the Plan | 929,064 | |||

| Total shares of Class A common stock outstanding | 15,300,691 | |||

The closing price of the Company’s Class A common stock on August 3, 2022 was $8.86 per share. The ratification and approval of the Share Increase Amendment is not anticipated to have any effect on the benefits to be received by the Company’s employees and officers under the Plan.

Vote Required for Approval and Recommendation of the Board of Directors

The Share Increase Amendment requires the approval of a majority of the votes cast on this proposal at the 2022 Annual Meeting, provided that a quorum is present. If the stockholders do not approve the Share Increase Amendment, the Company will continue to operate the Plan under its current provisions, but will be limited in its ability to make future grants and incentives under the Plan.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE AMENDMENT TO THE COMPANY’S 2017 OMNIBUS EQUITY INCENTIVE PLAN AS DESCRIBED HEREIN.

Summary of StockholdersMaterial Features of the Plan

The 2017 Omnibus Equity Incentive Plan (the “Plan”) is a comprehensive incentive compensation plan under which we can grant equity-based and other incentive awards to officers, employees and non-employee directors of, and consultants and advisers to, the Company and its subsidiaries (each, a “participant”). The purpose of the Plan is to help us attract, motivate and retain such persons and ensure that their compensation incentives are aligned with stock price appreciation.

Administration. The Plan is administered by the Compensation Committee of the Board of Directors (the “Plan Committee”), consisting of persons who are each (i) “Outside Directors” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), (ii) “non-employee directors” within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and (iii) “independent” for purposes of the director independence standards of NASDAQ.

| 7 |

Grant of Awards; Shares Available for Awards.

The Plan provides for the grant of awards which are incentive stock options (“ISOs”), non-qualified stock options (“NQSOs”), unrestricted shares, restricted shares, restricted stock units, performance stock, performance units, stock appreciation rights (“SARs”), tandem stock appreciation rights, distribution equivalent rights, or any combination of the foregoing, although only employees are eligible to receive ISOs. We have reserved a total of 4,000,000 shares of Class A common stock for issuance as or under awards to be made under the Plan. To the extent that an award (or portion of an award) lapses, expires, is canceled, is terminated unexercised or ceases to be exercisable for any reason, or the rights of its holder terminate, any shares subject to such award shall be deemed not to have been issued for purposes of determining the maximum aggregate shares which may be issued under the Plan and shall again be available for the grant of a new award. However, shares that have actually been issued under the Plan, shares not issued or delivered as a result of the net settlement of an SAR or option, shares used to pay the exercise price or withholding taxes related to an award, and shares repurchased on the open market with the proceeds from the exercise of any option, will not be available for future issuance under the Plan.

The number of shares for which awards which are options or SARs may be granted to a participant under the Plan during any calendar year is limited to 50,000 shares. For purposes of qualifying awards as “performance-based” compensation under Code Section 162(m), the maximum amount of cash compensation that may be paid to any person under the Plan in any single calendar year is $1,000,000. Such amount would act as a limit on cash payments made under Performance Unit Awards or Performance Stock Awards, but would not apply to other types of awards, such as Restricted Stock Unit Awards or Options.

Stock Options. The term of each stock option will be as specified in the option agreement; provided, however, that except for stock options which are ISOs, granted to an employee who owns or is deemed to own (by reason of the attribution rules applicable under Code Section 424(d)) more than 10% of the total combined voting power of all classes of shares of the Company or of any parent corporation or subsidiary corporation thereof (both as defined in Section 424 of the Code), within the meaning of Section 422(b)(6) of the Code (a “ten percent stockholder”), no option shall be exercisable after the expiration of ten (10) years from the date of its grant (five (5) years for an employee who is a ten percent stockholder). The price at which a share may be purchased upon exercise of a stock option shall be determined by the Plan Committee; provided, however, that such option price (i) shall not be less than the fair market value of an share on the date such stock option is granted, and (ii) shall be subject to adjustment as provided in the Plan. In addition, the Plan provides that an option agreement may allow the underlying stock option to be settled by the delivery of cash rather than shares, with a cash amount equal to the value of shares that would be deliverable to a participant under the “cashless exercise” procedure described in Section 7.4 of the Plan. The decision to deliver cash rather than shares will be made in the sole discretion of the Plan Committee.

The Plan also prohibits the Plan Committee from “re-pricing” outstanding stock options (reducing the exercise price of an outstanding option or granting a new award or payment in substitution for or upon cancellation of options previously granted) without advance approval of the Company’s stockholders or as a result of a change of control, recapitalization or reorganization as provided in the Plan.

Unrestricted Stock Awards. Pursuant to the terms of the applicable unrestricted stock award agreement, an unrestricted stock award is the award or sale of shares to employees, non-employee directors or non-employee consultants, which are not subject to transfer restrictions in consideration for past services rendered to the Company or for other valid consideration.

Restricted Stock Awards. A restricted stock award is a grant or sale of shares to the holder, subject to such restrictions on transferability, risk of forfeiture and other restrictions, if any, as the Plan Committee or the Board of Directors may impose, which restrictions may lapse separately or in combination at such times, under such circumstances (including based on achievement of performance goals and/or future service requirements), in such installments or otherwise, as the Plan Committee or the Board of Directors may determine at the date of grant or purchase or thereafter.

| 8 |

Restricted Stock Unit Awards. A restricted stock unit award provides for a grant of shares or a cash payment to be made to the holder upon the satisfaction of predetermined individual service-related vesting requirements, based on the number of units awarded to the holder. The Plan Committee will set forth in the applicable restricted stock unit award agreement the individual service-based vesting requirements which the holder would be required to satisfy before the holder would become entitled to payment and the number of units awarded to the holder. At the time of such award, the Plan Committee may, in its sole discretion, prescribe additional terms and conditions or restrictions. The holder of a restricted stock unit will be entitled to receive a cash payment equal to the fair market value of a share, or one (1) share, as determined in the sole discretion of the Plan Committee and as set forth in the restricted stock unit award agreement, for each restricted stock unit subject to such restricted stock unit award, if and to the extent the holder satisfies the applicable vesting requirements.

Squire JungerPerformance Stock Awards. , age 70, becameA performance stock award provides for the distribution of shares (or cash equal to the fair market value of shares) to the holder upon the satisfaction of predetermined individual and/or FAT Brands goals or objectives. The Plan Committee will set forth in the applicable performance stock award agreement the performance goals and objectives (and the period of time to which such goals and objectives shall apply) which the holder and/or the Company would be required to satisfy before the holder would become entitled to the receipt of shares (or cash equal to the fair market value of shares) pursuant to such holder’s performance stock award and the number of shares of shares subject to such performance stock award.

Performance Unit Awards. A performance unit award provides for a membercash payment to be made to the holder upon the satisfaction of predetermined individual and/or Company (or affiliate) performance goals or objectives based on selected performance criteria, based on the number of units awarded to the holder. The Plan Committee will set forth in the applicable performance unit award agreement the performance goals and objectives (and the period of time to which such goals and objectives shall apply) which the holder and/or the Company would be required to satisfy before the holder would become entitled to payment, the number of units awarded to the holder and the dollar value assigned to each such unit. At the time of such award, the Plan Committee may, in its sole discretion, prescribe additional terms and conditions or restrictions. The holder of a performance unit will be entitled to receive a cash payment equal to the dollar value assigned to such unit under the applicable performance unit award agreement if the holder and/or the Company satisfies (or partially satisfies, if applicable under the applicable performance unit award agreement) the performance goals and objectives set forth in such performance unit award agreement.

Stock Appreciation Rights. An SAR provides the participant to whom it is granted the right to receive, upon its exercise, cash or shares equal to the excess of (A) the fair market value of the boardnumber of directorsshares subject to the SAR on the date of exercise, over (B) the product of the number of shares subject to the SAR multiplied by the base value for the SAR, as determined by the Plan Committee or the Board of Directors. The Plan Committee will set forth in the applicable SAR award agreement the terms and conditions of the SAR, including the base value for the SAR (which shall not be less than the fair market value of an share on the date of grant), the number of shares subject to the SAR and the period during which the SAR may be exercised and any other special rules and/or requirements which the Plan Committee imposes on the SAR. No SAR will be exercisable after the expiration of ten (10) years from the date of grant. A tandem SAR is a SAR granted in connection with a related option, the exercise of some or all of which results in termination of the entitlement to purchase some or all of the shares under the related option. If the Plan Committee grants a SAR which is intended to be a tandem SAR, the tandem SAR will be granted at the same time as the related option and additional restrictions apply.

Distribution Equivalent Rights. A distribution equivalent right entitles the holder to receive bookkeeping credits, cash payments and/or share distributions equal in amount to the distributions that would be made to the holder had the holder held a specified number of shares during the period the holder held the distribution equivalent rights. The Plan Committee will set forth in the applicable distribution equivalent rights award agreement the terms and conditions, if any, including whether the holder is to receive credits currently in cash, is to have such credits reinvested (at fair market value determined as of the date of reinvestment) in additional shares or is to be entitled to choose among such alternatives.

Recapitalization or Reorganization. Subject to certain restrictions, the Plan provides for the adjustment of shares underlying awards previously granted if, and whenever, prior to the expiration or distribution to the holder of shares underlying an award theretofore granted, the Company shall effect a subdivision or consolidation of our shares or the payment of a stock dividend on shares without receipt of consideration by the Company.

| 9 |

Change of Control. The Plan provides that the Committee may, in its discretion, in connection with a Change of Control event (as defined in the Plan) provide for the acceleration of any time periods, or the waiver of any other conditions, relating to the vesting, exercise, payment or distribution of an Award so that any Award to a person whose employment has been terminated as a result of a Change of Control may be vested, exercised, paid or distributed in full on or before a date fixed by the Committee, or provide for the purchase of Awards from an employee whose employment has been terminated as a result of a Change of Control.

Amendment and Termination. The Plan will continue in effect, unless sooner terminated pursuant to its terms, until the tenth anniversary of the date on which it was originally adopted by the Board of Directors (except as to awards outstanding on that date). The Board of Directors may terminate the Plan at any time with respect to any shares for which awards have not theretofore been granted; provided, however, that the Plan’s termination shall not materially and adversely impair the rights of a holder with respect to any award theretofore granted without the consent of the holder. The Board of Directors will have the right to alter or amend the Plan or any part thereof from time to time; provided, however, that without the majority vote of our stockholders, no amendment or modification of the Plan may (i) materially increase the benefits accruing to holders, (ii) except as otherwise expressly provided in the Plan, materially increase the number of shares subject to the Plan or the individual award agreements, (iii) materially modify the requirements for participation, or (iv) amend, modify or suspend certain re-pricing prohibitions or amendment and termination provisions as specified in the Plan.

Certain U.S. Federal Income Tax Consequences of the Plan

The following is a general summary of certain U.S. federal income tax consequences under current tax law to the Company (to the extent it is subject to U.S. federal income taxation on its net income) and to participants in the Plan who are individual citizens or residents of the United States for federal income tax purposes (“U.S. Participants”) of stock options which are ISOs, or stock options which are NQSOs, unrestricted stock, restricted stock, restricted stock units, performance stock, performance units, SARs, and dividend equivalent rights. This summary does not purport to cover all of the special rules that may apply, including special rules relating to limitations on our ability to deduct certain compensation, special rules relating to deferred compensation, golden parachutes, U.S. Participants subject to Section 16(b) of the Exchange Act or the exercise of a stock option with previously-acquired shares. This summary assumes that U.S. Participants will hold their shares as capital assets within the meaning of Section 1221 of the Code. In addition, this summary does not address the foreign, state or local or other tax consequences, or any U.S. federal non-income tax consequences, inherent in the acquisition, ownership, vesting, exercise, termination or disposition of an award under the Plan, or shares issued pursuant thereto. Participants are urged to consult with their own tax advisors concerning the tax consequences to them of an award under the Plan or shares issued thereunder pursuant to the Plan.

A U.S. Participant generally does not recognize taxable income upon the grant of a NQSO if structured to be exempt from or comply with Code Section 409A. Upon the exercise of a NQSO, the U.S. Participant generally recognizes ordinary compensation income in an amount equal to the excess, if any, of the fair market value of the shares acquired on the date of exercise over the exercise price thereof, and the Company generally will be entitled to a deduction for such amount at that time. If the U.S. Participant later sells shares acquired pursuant to the exercise of a NQSO, the U.S. Participant recognizes a long-term or short-term capital gain or loss, depending on the period for which the shares were held. A long- term capital gain is generally subject to more favorable tax treatment than ordinary income or a short-term capital gain. The deductibility of capital losses is subject to certain limitations.

A U.S. Participant generally does not recognize taxable income upon the grant or, except for purposes of the U.S. alternative minimum tax (“AMT”) the exercise, of an ISO. For purposes of the AMT, which is payable to the extent it exceeds the U.S. Participant’s regular income tax, upon the exercise of an ISO, the excess of the fair market value of the shares subject to the ISO over the exercise price is a preference item for AMT purposes. If the U.S. Participant disposes of the shares acquired pursuant to the exercise of an ISO more than two years after the date of grant and more than one year after the transfer of the shares to the U.S. Participant, the U.S. Participant generally recognizes a long-term capital gain or loss, and the Company will not be entitled to a deduction. However, if the U.S. Participant disposes of such shares prior to the end of either of the required holding periods, the U.S. Participant will have ordinary compensation income equal to the excess (if any) of the fair market value of such shares on the date of exercise (or, if less, the amount realized on the disposition of such shares) over the exercise price paid for such shares, and the Company generally will be entitled to deduct such amount.

A U.S. Participant generally does not recognize income upon the grant of a SAR. The U.S. Participant recognizes ordinary compensation income upon exercise of the SAR equal to the increase in the value of the underlying shares, and the Company generally will be entitled to a deduction for such amount.

A U.S. Participant generally does not recognize income on the receipt of a performance stock award, performance unit award, restricted stock unit award, unrestricted stock award or dividend equivalent rights award until a cash payment or a distribution of shares is received thereunder. At such time, the U.S. Participant recognizes ordinary compensation income equal to the excess, if any, of the fair market value of the shares or the amount of cash received over any amount paid therefor, and the Company generally will be entitled to deduct such amount at such time.

A U.S. Participant who receives a restricted stock award generally recognizes ordinary compensation income equal to the excess, if any, of the fair market value of such shares at the time the restriction lapses over any amount paid for the shares. Alternatively, the U.S. Participant may make an election under Section 83(b) of the Code to be taxed on the fair market value of such shares at the time of grant. The Company generally will be entitled to a deduction at the same time and in the same amount as the income that is required to be included by the U.S. Participant.

ADVISORY VOTE ON THE COMPENSATION OF NAMED EXECUTIVE OFFICERS

In accordance with Section 14A of the Exchange Act, we are asking stockholders to approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in accordance with the SEC’s rules in the “Executive Compensation” section of this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address any specific item of compensation or any specific named executive officer, but rather the overall compensation of all of our named executive officers and the philosophy, policies and practices described in this proxy statement as a whole.

The say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation Committee or our Board of Directors. The say-on-pay vote will, however, provide information to us regarding investor sentiment about our executive compensation philosophy, policies and practices, which the Compensation Committee will be able to consider when determining future executive compensation. The Board of Directors and Compensation Committee value the opinions of our stockholders and to the extent there is any significant vote against our named executive officer compensation as disclosed in this proxy statement, we will consider our stockholders’ concerns and the Compensation Committee will evaluate whether any additional actions are necessary.

Stockholders are urged to read the Summary Compensation Table and other related compensation tables and narrative under the heading “Executive Compensation” below, which provide specific information on the compensation of the named executive officers. The Compensation Committee and Board of Directors believe that the Company’s policies and procedures are effective in achieving our goals, and that the compensation of the named executive officers reported in this proxy statement reflects and supports these compensation policies and procedures.

Based on the above, the Company is asking stockholders to approve the following advisory resolution at the Annual Meeting:

“RESOLVED, that the stockholders of FAT Brands Inc. approve, on October 20, 2017. Mr. Junger is a co-founder and a managing membernon-binding advisory basis, the compensation of Insight Consulting LLC, a management consulting firm basedthe Company’s named executive officers as disclosed in the Los Angeles area, providing adviceSummary Compensation Table and the related compensation tables, notes and narrative in mergers and acquisitions, corporate divestitures, business integration diagnostics, real estate investment, acquisition, development and construction and litigation support services. Priorthe proxy statement for the Company’s Annual Meeting.”

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS.

ADVISORY VOTE ON THE FREQUENCY OF

FUTURE VOTES ON THE COMPENSATION OF NAMED EXECUTIVE OFFICERS

In accordance with Section 14A of the Exchange Act, we are asking stockholders to co-founding Insightvote on whether future non-binding advisory votes on executive compensation (such as Proposal No. 3 in 2003 he was a partner at Arthur Andersen LLP, which he joined in 1972. Mr. Junger co-developed and managedthis proxy statement) should occur every one year, every two years or every three years. This is the west coast Transaction Advisory Services practice at Andersen, providing comprehensive merger and acquisition consulting services to both financial and strategic buyers and sellers. Mr. Jungerfirst year that the non-binding advisory vote on executive compensation (Proposal No. 3) is a certified public accountant in California and received Bachelor of Science and M.B.A. degrees from Cornell University. Mr. Junger was selected tobeing held. After careful consideration, our Board of Directors because he brings substantial expertisehas determined that a vote on executive compensation that occurs annually is the most appropriate alternative for the Company, and therefore recommends that you vote for a one-year interval for future non-binding votes on executive compensation.

In formulating its recommendation, our Board of Directors considered that since compensation decisions are made annually, an annual advisory vote on executive compensation will allow stockholders to provide more frequent and direct input on our compensation philosophy, policies and practices. An annual approach provides regular input by stockholders, while allowing time to evaluate the effects of our compensation program on performance over a longer period. However, we understand that our stockholders may have different views as to what is the best approach for the Company, and we look forward to hearing from our stockholders on this proposal.

You may cast your vote on your preferred voting frequency by choosing the option of one year, two years, three years or abstain from voting when you vote in financialresponse to the resolution set forth below:

“RESOLVED, that the option of once every one year, two years, or three years that receives the highest number of votes cast for this resolution will be determined to be the preferred frequency with which the Company is to hold a stockholder vote to approve the compensation of the named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and strategic planning, mergersExchange Commission, including the compensation tables and acquisitions,other related disclosure.”

The option of one year, two years or three years that receives the highest number of votes cast by stockholders will be the frequency for the advisory vote on executive compensation that has been selected by stockholders. However, this vote is advisory and leadershipis not binding on the Company, the Compensation Committee or our Board of complex organizations.Directors. The Board may decide that it is in the best interests of our stockholders and the Company to hold an advisory vote on executive compensation more or less frequently than the option approved by our stockholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR “ONE YEAR” AS THE FREQUENCY WITH WHICH STOCKHOLDERS ARE PROVIDED FUTURE ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

Meetings of the Board of DirectorsPROPOSAL NO. 5

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

DuringA resolution will be presented at the Annual Meeting to ratify the appointment by our Audit Committee of Baker Tilly US, LLP as our independent registered public accounting firm to examine our financial statements for the fiscal year endedending December 29, 2019, the Board of Directors held four meetings. Each incumbent director attended at least 75% of the aggregate number of meetings of the board of directors25, 2022, and meetings of the committeesto perform other appropriate accounting services.

THE BOARD OF DIRECTORS RECOMMEND A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF BAKER TILLY US, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 25, 2022.

The Audit Committee of the Board of Directors originally engaged Baker Tilly US, LLP (“Baker Tilly”) as our independent registered public accounting firm in November 2020, replacing Squar Milner LLP (“Squar Milner”), whose audit practice was combined with Baker Tilly. Squar Milner was previously engaged as our independent registered public accounting firm since June 2019.

Prior to engaging Baker Tilly, the Company did not consult with such firm regarding the application of accounting principles to a specific completed or contemplated transaction or regarding the type of audit opinion that might be rendered by such firm on the Company’s financial statements, and such firm did not provide any written or oral advice that was an important factor considered by the Company in reaching a decision as to any such accounting, auditing or financial reporting issue. The reports of Baker Tilly on the Company’s financial statements for the 2021 and 2020 fiscal years did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the year fiscal ended December 27, 2020, there were no disagreements (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and related instructions) with Squar Milner on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which hedisagreements, if not resolved to the satisfaction of Squar Milner would have caused it to make reference to such disagreement in its reports.

The Audit Committee reviews the independence of our independent registered public accounting firm on an annual basis and has determined that Baker Tilly US, LLP is independent. In addition, the Audit Committee pre-approves all work and fees that are performed by our independent registered public accounting firm.

Representatives of Baker Tilly are expected to attend the Annual Meeting or she serves, except that Jeff Lotman who attended 60%be available by telephone conference to respond to appropriate questions and will have the opportunity to make a statement, if desired.

The affirmative vote of the meetingsholders of a majority of the shares represented in person or by proxy and entitled to vote on this item will be required to ratify the appointment of Baker Tilly. The Board of Directors recommends a vote “FOR” the ratification of its appointment of Baker Tilly as our independent registered public accounting firm. If not otherwise specified, validly executed proxies will be voted “FOR” this proposal.

Although stockholder ratification of the appointment of our independent registered public accounting firm is not required by our bylaws or otherwise, we are submitting the selection of Baker Tilly to our stockholders for ratification to permit stockholders to participate in this important corporate decision. If not ratified, the Audit Committee will reconsider the selection, although the Audit Committee will not be required to select a different independent registered public accounting firm for our Company.

Audit Fees. Baker Tilly US, LLP, Los Angeles, California, has served as our independent registered public accounting firm for the fiscal years ending December 26, 2021 and December 27, 2020. The aggregate accounting fees for these fiscal are as follows (dollars in thousands):

December 26, 2021 | December 27, 2020 | |||||||

| Audit fees | $ | 1,128 | $ | 329 | ||||

| Audit related fees | $ | 418 | $ | 45 | ||||

| Tax fees | $ | – | $ | – | ||||

| All other fees | $ | – | $ | – | ||||

| 13 |

Board Composition and Leadership Structure

From the inception of our Company in 2017 until July 2022, Edward Rensi served as the independent Chairman of our Board of Directors. In July 2022, James Neuhauser, who served as an independent director since our inception, was appointed Executive Chairman of the Board of Directors and meetings of committeesMr. Rensi became Vice-Chairman and Lead Independent Director. Our founder, Andrew Wiederhorn, continues to serve as President and Chief Executive Officer of the Board of Directors on which he serves.

EachCompany and a member of the Board of DirectorsDirectors. The Board believes that the Company and its stockholders are best served by this leadership structure because it is expectedvaluable to attend annualhave the breadth of experience and depth of knowledge of our Chief Executive Officer and Executive Chair, balanced by the significant role of our Lead Independent Director in overseeing management and leading meetings of our stockholders, eitherindependent directors.

Board’s Role in person or telephonically,Risk Oversight

Our Board of Directors believes that open communication between management and eachthe Board member attendedof Directors is essential for effective risk management and oversight. The Board meets with our 2019 annual meetingChief Executive Officer and other members of stockholderssenior management at Board of Director meetings, where, among other topics, they discuss strategy and risks in person, exceptthe context of reports from the management team and evaluate the risks inherent in significant transactions. While our Board of Directors is ultimately responsible for Mr. Holtzman who attendedrisk oversight, our Board committees assist the 2019 annual meeting telephonicallyBoard of Directors in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in the areas of major financial risk exposures, internal control over financial reporting, disclosure controls and Mr. Lotman who did not attend. Dueprocedures, legal and regulatory compliance. The Compensation Committee assists the Board in assessing risks created by the incentives inherent in our compensation policies. The Nominating and Corporate Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the COVID-19 pandemic, we do not expect that allmanagement of our directors will attend the Annual Meeting in person.corporate, legal and regulatory risk.

Director Independence

The Board has determined that each of the current directors other than Mr.and nominees, except Messrs. Neuhauser and Wiederhorn, is independent within the meaning of the applicable rules and regulations of the Securities and Exchange Commission (referred to as the SEC)SEC and the director independence standards of The Nasdaq Stock Market LLC (“NASDAQ”), as currently in effect. Furthermore, the Board has determined that each current member of the Committees of theeach Board committee is “independent” under the applicable rules and regulations of the SEC and the director independence standards of NASDAQ applicable to each such committee, as currently in effect.

Code of Ethics

The Board of Directors hasWe have adopted a written code of business ethics designed, in part,that applies to deter wrongdoingour directors, officers and to promote honest and ethical conduct,employees, including the ethical handling of actualour principal executive officer, principal financial officer, principal accounting officer or apparent conflicts of interest between personal and professional relationships, full, fair, accurate, timely and understandable disclosure in reports and documents that we file withcontroller, or submit to the SEC and in our other public communications, compliance with applicable governmental laws, rules and regulations, the prompt internal reporting of violationspersons performing similar functions. We have posted a current copy of the code under the Corporate Governance section of our website at https://ir.fatbrands.com. In addition, we intend to an appropriate personpost on our website all disclosures that are required by law or persons, as identified in the code, and accountability for adherenceNASDAQ listing standards concerning any amendments to, or waivers from, any provision of the code.

Anti-Hedging Policy and Trading Restrictions

The code of ethics applies to all ofCompany’s Insider Trading Policy restricts certain transactions in our securities and prohibits our directors, executive officers and employees. A copycertain other key employees (and their respective family and household members) from purchasing or selling any type of security while aware of material non-public information about the codeCompany or from providing such material non-public information to any person who may trade while aware of ethicssuch information. Trading by our officers and directors, as well as other employees who may be expected in the ordinary course of performing their duties to have access to material non-public information, is available in on our website at https://ir.fatbrands.com/corporate-governance.